Completely Remote Property Tax Assessment Appeals and Exemptions

Property owners who wish to dispute their tax burden with a property tax assessment appeal or request an exemption are often faced with time-intensive and convoluted processes that heavily rely on antiquated paper systems. Complex manual processes increase the time it takes to manage these appeals and exemptions and resolve each case. This leads to frustration for both internal and external stakeholders, and ultimately constituents are left both exasperated and defeated.

Society has become accustomed to instant gratification. With the use of cloud solutions in government on the rise, citizens now demand efficient ways of handling personal business as it relates to government, like that of the commercial space, from the comfort of their own homes.

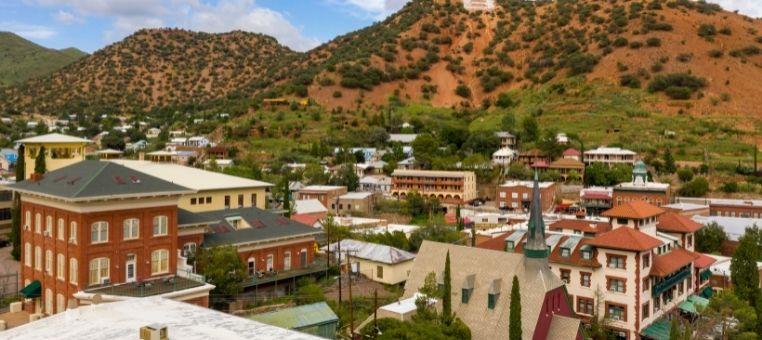

Purpose-built for government, AST’s Assessment Appeals and Exemptions solution provides a template for state and local governments to allow their citizens (residential and commercial property owners) to appeal their property tax assessments and file exemptions completely online. AST’s solution eliminates manual paper processes by moving the entity to an efficient online system. Once an appeal is filed, the constituent can monitor and manage the entire process without waiting in lines or leaving home.

AST’s Appeals and Exemptions solution provides automation to empower a broad range of government organizations. The solution is built on a flexible Salesforce foundation, which allows you to choose from varying models to meet your agency’s specific needs:

- An end-to-end model for complete automation of the assessment appeals and exemption process

- An a la carte set of process-specific improvements to automate

Let AST modernize your processes and implement a solution utilizing industry best-practices for your property tax assessment appeals and exemptions. The solution will save your citizens time and energy while also providing them increased visibility. The implementation will serve both long-term and short-term goals, reducing expenditures and individual application processing times.

- Cloud-based central repository creating an organizational system of record

- Automated case creation

- Robust back-end processing with automations and workflows to ease burden on staff

- Integration with electronic signatures and other tools, including legacy systems

- Analytics with customizable reports and dashboards for staff

- Portal access for applicant status monitoring

- 24/7 system availability

- Self-service applications

- Amendments

- Postponements

- Withdrawals

- Automated digital PDF reviews for those unable to submit through online portal

Our solution is comprised of the following technology stack:

- Salesforce Public Sector Solutions or Service Cloud

- Salesforce Experience Cloud

- Salesforce Maps

- Electronic Signature Platform – DocuSign (or other compatible e-signature application)

- API Integration – Property Information (or other required data sources)

Key Benefits of the AST Property Tax Assessment Appeals and Exemptions Solution

Modern

Manage the entire process remotely – from application to resolution.

Automated

Eliminate manual and paper-based process components.

Efficient

Process appeals and exemptions faster and with greater accuracy.

Filing for refunds just became easier, and for good reason. Because of the pandemic, the new normal may be that people can't visit government offices to submit documents or get answers to questions about their tax bill in person. So, we'll let them 'visit' from home.

Maria Pappas Treasurer, Cook County, ILCase Studies